tax on venmo over 600

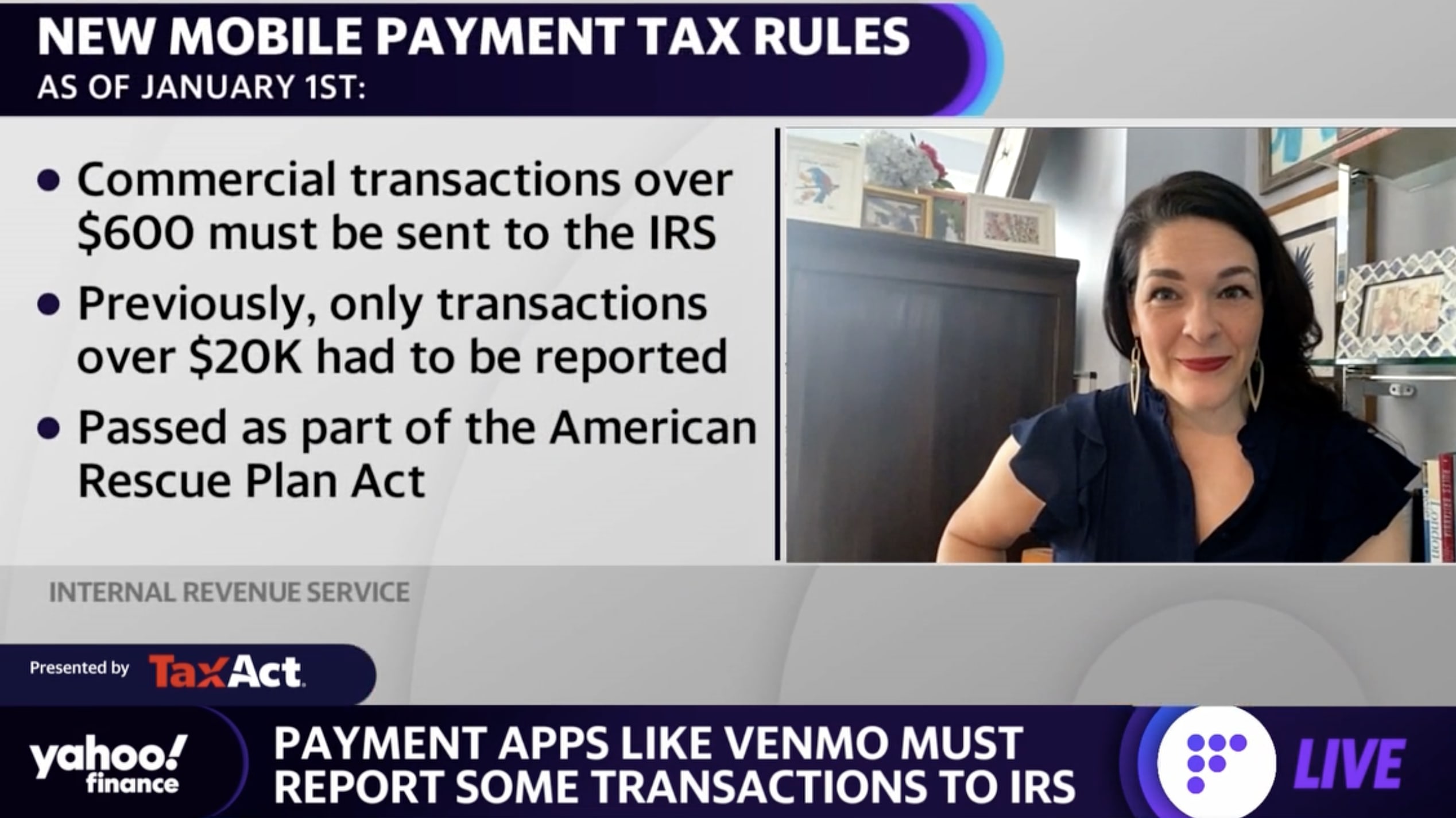

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Under the IRS new.

Average Generator Cost Forbes Advisor

PayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

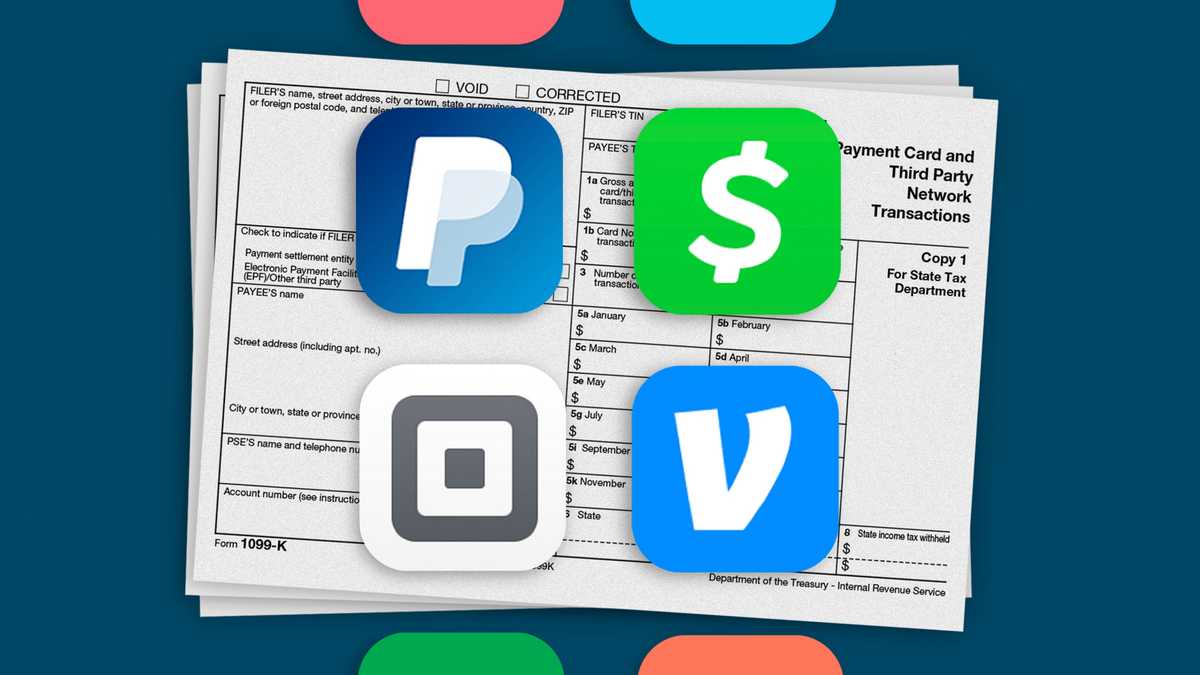

. Earnings over 600 will be reported to the IRS. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. News Sports Things To. This does not mean that you will.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more. January 19 2022 204 PM 2 min read. Larry Edwards is a tax.

The IRS is cracking down on the apps to make. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. Theres a little bit of confusion over this Venmo rule says Steven Rosenthal senior fellow at the Urban.

Thanks to the new American Rescue Plan Act of 2021 services like Venmo and Cash App will now begin sending out 1099-K tax forms to anyone receiving payments of 600. As long as youre not making additional income over 600 via these apps you should be in the clear. No Venmo isnt going to tax you if you receive more than 600.

The American Rescue Plan Act passed by Congress on March 11 includes a new rule that applies to business transactions over 600 which are often paid through cash apps. The American Rescue Plan Act will change how some are taxed for receiving over 600 in third-party funds for online sales on sites like Etsy and eBay. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year.

This only applies for income that would normally be reported to the IRS anyway. Per last years American Rescue Plan Act so-called peer-to-peer payment platforms like Venmo or Paypal will now have to report any persons cumulative business. For most states the threshold is.

Rather small business owners independent. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue. This new rule wont affect 2021 federal tax returns but now.

The IRS is coming after anyone who receives over 600 in payments for goods or services processed by third-party payment apps like Paypal or Venmo. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Business Venmo transactions over 600 taxed.

Venmo Etsy other sites add forms for payments over 600. Taxes Get Ready to Pay Taxes on Money Earned Through Paypal and Venmo Next Year. That means if you borrow money using any.

AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS. Anyone who receives at least. If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out.

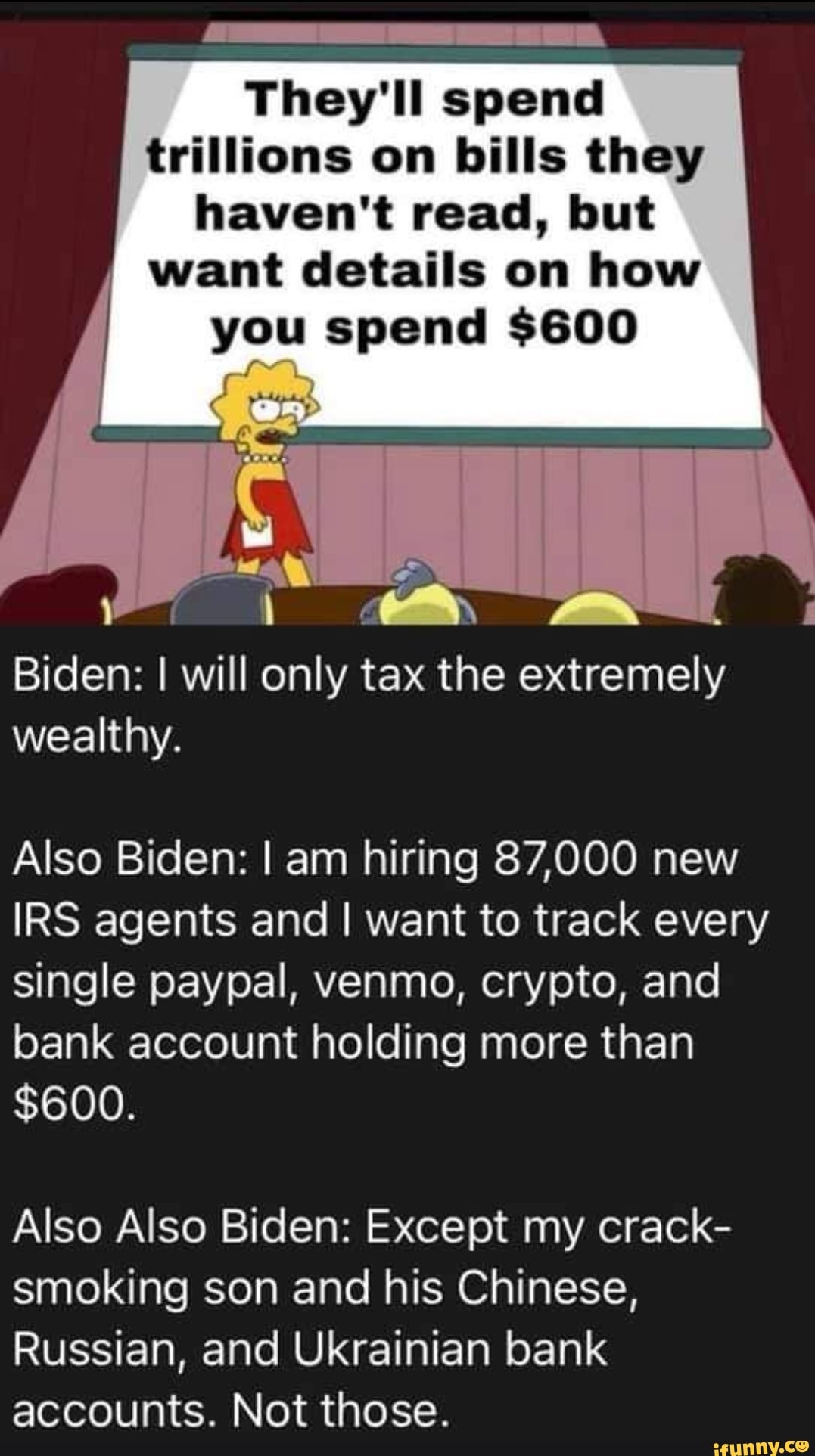

Americans for Tax Reform President Grover Norquist discusses the impact of third-party. Dont Believe The Hype Bidens 600 Tax Plan Wont Force You to Report All Venmo Transactions to the IRS TRENDING 1. Etsy and Airbnb will begin receiving tax forms if they take a payment of more than 600.

One by one in recent. As of Jan. It applies to your 2022 taxes which youll file in the spring of 2023.

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. One Facebook post claims the new tax bill would tax transactions exceeding 600 on smartphone apps like PayPal and Venmo. If youre making money via payment apps.

Venmo tax reporting 2022 reddit.

New Tax Rule With Venmo Cash App And Paypal Could Impact Your Business

/cloudfront-us-east-1.images.arcpublishing.com/gray/VEVR3Z64VZCVDJQDLCUFKCT6NI.jpg)

Use Venmo Tax Changes Are Coming

They Ll Spend Trillions On Bills They Haven T Read But Want Details On How You

Why Are They Snooping On An Average Joe Over A 600 Payment World News Today Stand Up World News Today How To Plan Snoop

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-05-2022/t_922560b2db1b4cd3a10b798a2d631ae6_name_Venmo_Paypal_must_report_payments_of_600_61d595b2283c07051d1095e4_1_Jan_05_2022_13_11_02_poster.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Wsb Tv Channel 2 Atlanta

Irs 600 Bank Surveillance Rule For 2022 Cash App Venmo Paypal Zelle Status Update Youtube

Mosheh Oinounou On Instagram A New Provision In The 3 5 Trillion Budget Bill Requiring Banks And Cash Apps Like Venm Budgeting Accounting Information Venmo

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/7XQSQOTTARBLLM3GALGXEIPZEY.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Wsb Tv Channel 2 Atlanta

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Update 10 000 Irs Banks 600 Cash App Reporting Answering Questions New Tax Laws Explained Youtube

Pin On Meaning Of Accounting In Simple Words

New Tax Rule Requires Money Apps To Report Transactions Totaling More Than 600 Year Ktalnews Com

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Eyeshadow Storage Rack Makeup Rack Thread Spool Holder Display Rack Ideas Thread Storage Thread Spools

Consider Using Their Tax Refund Toward A Down Payment Contact Brad Today To Start Shopping For That Next Home Tax Refund Down Payment Home Buying

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Larson Accouting

New Tax Law Requires Third Party Sellers To Pay Taxes On Earnings Over 600

How To Stop Your Teenager Being Charged By The Irs For Sending Money To Their Friends On Venmo And Paypal